The Opportunity

Why Invest in Multifamily?

Historically, multifamily has delivered the highest returns with the least risk of all major real estate sectors. These investments typically generate multiple streams of income and can appreciate in value over time, offering potential long-term capital gains to investors.

The Benefits of Investing in Multifamily Properties

Lower vacancy risk

Multiple tenants ensure consistent rental income.

Appreciation potential

Properties can appreciate in value over time.

Forced appreciation

Strategic property improvements can increase rental income and overall value.

9.75%

The multifamily sector generated an average annual total return of 9.75% from 2000-2020, outperforming several other major property types.*

4.3 million

The U.S. is projected to create 4.3 million new multifamily households by 2035, highlighting the increasing demand for multifamily housing.**

The Problem

A Growing Problem

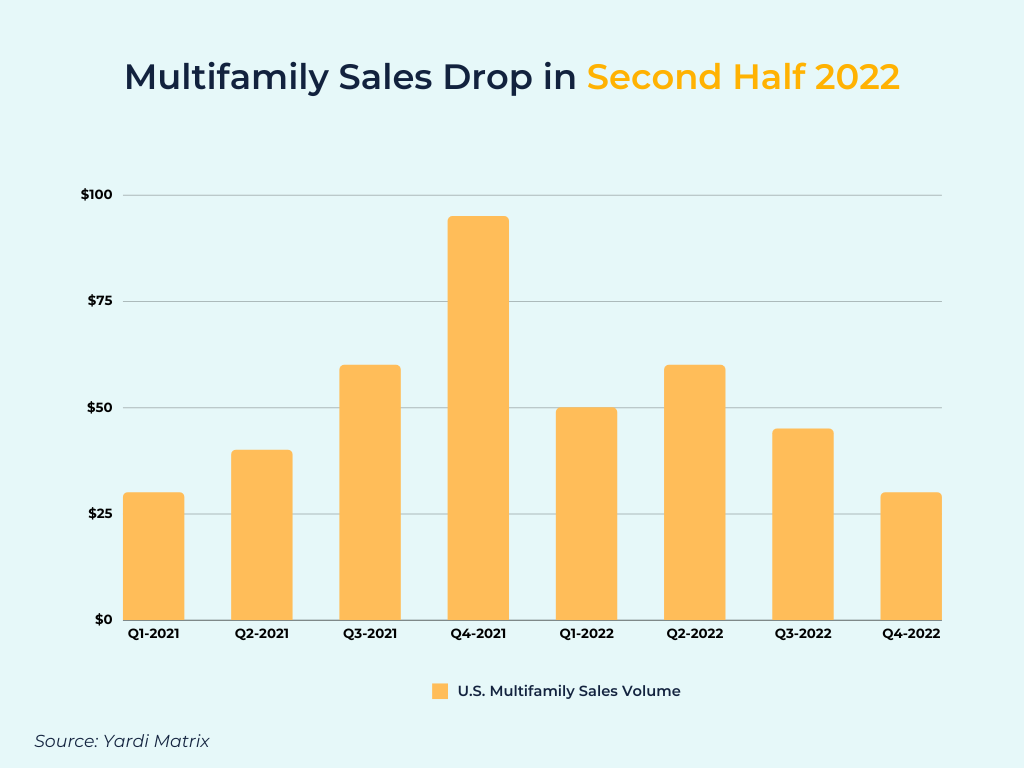

In 2021, the multifamily real estate market experienced its second-highest year in transaction volume, recording $227 billion in national sales. This peak, combined with shifts in the national financial climate, altered institutional demand. This change paved the way for acquisition opportunities at significant discounts, with minimal competition.

Ideal Passive Investment Opportunity

Why SubTo Fund?

- 40+ Years of Real Estate Experience

- 60+ Years of Business Experience

- 30+ Years of Successfully Raising Funds for Regulation D

- 20+ Years of Acquisition and Underwriting Experience, Enabling Informed Investment Decisions